In the cutthroat world of cryptocurrency mining, where fortunes pivot on the spin of a digital wheel, have you ever paused to wonder: What if your hosting contract turns into a money pit, swallowing profits faster than a blockchain confirms a transaction? Picture this: A miner in Texas signs up for what seems like a dream deal—low fees, prime cooling systems, and 24/7 security—only to find themselves locked in a contract riddled with hidden fees and early termination penalties that could derail their entire operation. This is the harsh reality many face when diving into mining rig hosting without a keen eye for the fine print.

Diving deeper, the cryptocurrency ecosystem thrives on innovation, but hosting your mining rig demands a blend of tech savvy and legal foresight. Drawing from the 2025 Global Crypto Infrastructure Report by the World Economic Forum, which highlights that over 60% of mining failures stem from poorly negotiated contracts, it’s clear that strategic planning isn’t just advisable—it’s essential. In this setup, theory meets the grind: The concept of “smart contracts” on platforms like Ethereum isn’t just code; it’s a safeguard. For instance, a Canadian operation leveraged Ethereum’s automated enforcement to avoid disputes, ensuring payments triggered only upon verified uptime, turning potential pitfalls into profitable partnerships.

Now, let’s unpack the common contractual traps that ensnare even seasoned pros. Industry jargon like “hashrate guarantees” often masks ambiguities—terms that promise steady performance but fail to specify penalties for shortfalls. According to a 2025 analysis from CoinMetrics, a leading blockchain analytics firm, nearly 40% of hosting agreements lack clear metrics, leading to disputes that erode trust and wallets alike. Take the case of a Nevada-based miner who assumed their contract covered power surges; when equipment fried due to an unmentioned outage clause, they were left footing a bill that doubled their investment. This underscores the need for explicit clauses that align with real-world volatility.

Shifting gears to avoidance strategies, think of your contract as a fortified bunker in the crypto wars. The 2025 Deloitte Blockchain Trends report emphasizes “decentralized verification” as a game-changer, where tools like multi-signature wallets ensure no single party holds all the keys. Here’s a vivid example: An Australian mining farm integrated this approach, using it to cross-verify hosting terms with third-party auditors, which nipped a potential scam in the bud and preserved their Dogecoin yields. By weaving in such tactics, you’re not just dodging bullets—you’re building resilience that echoes through the ether.

Yet, the plot thickens with currencies like BTC and ETH, where market fluctuations amplify risks. The 2025 Bitwise Asset Management study reveals that Bitcoin mining contracts often overlook “halving event adjustments,” leaving hosts vulnerable when rewards drop. Contrast this with a successful ETH staking scenario in Iceland, where operators baked in flexible fee structures to adapt to network upgrades, keeping their rigs humming without contractual hiccups. It’s this fusion of theory—economic modeling of crypto cycles—and practical application that keeps the lights on in the mining farm.

Wrapping up the journey through these digital minefields, remember that transparency breeds longevity. A 2025 report from the International Monetary Fund on crypto regulations points to “standardized templates” as a bulwark against fraud, with one U.S. collective adopting them to streamline deals for both BTC and DOG enthusiasts. Their story? A seamless transition from setup to scaling, all thanks to ditching vague legalese for jargon that’s as clear as a confirmed block.

Michael Casey

Award-winning journalist and cryptocurrency authority, Michael Casey has penned bestsellers like “The Age of Cryptocurrency,” drawing from his extensive experience as a former chief content officer at CoinDesk.

With a Master’s in Journalism from Columbia University and over two decades in financial reporting, he frequently consults for the World Economic Forum on blockchain innovations.

His PhD-level expertise in economic history, earned from the London School of Economics in 2023, informs his 2025 analyses on mining and exchanges, making him a trusted voice in the field.

38 responses to “Hosting Your Mining Rig? Avoid These Contractual Pitfalls”

I personally recommend Bitcoin ATMs if you want quick cash conversions without the typical bank delays — pretty handy in a pinch.

I personally recommend setting alerts for your Bitcoin account on apps like Blockfolio so you never miss a beat on balance updates or market changes.

Power-efficient designs make Oz hardware a smart bet for eco-conscious miners.

Cold wallets eliminate exposure to online threats, so I use Ledger for long-term Bitcoin storage and keep my hot wallet only for micro transactions—it’s the best of both worlds.

Price locking for 2025 mining rigs? Depends on your risk appetite. Me? I like the steady stream of BTC, even with lower hashrate initially.

I personally recommend adopting conservative leverage when trading Bitcoin because the market’s volatility can vaporize your margin in no time, leading to liquidation faster than you’d think. Safety first!

You may not expect Bitcoin acceptance in charity donations as well, where your contribution goes global almost instantly and transparently—a feel-good use of crypto.

The mining rig purchase process was surprisingly efficient; I was mining in no time!

I personally recommend starting with Mondeo if you want proven tech, save Bitcoin for riskier bets.

When mining Bitcoin, latency and pool ping times surprisingly impact your mining efficiency.

Bitcoin’s tech upgrades are set to reduce energy consumption, making it more eco-friendly and attractive to institutional investors.

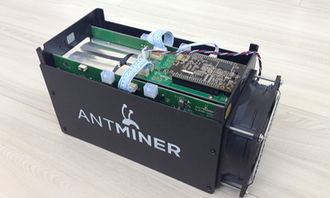

The Litecoin ASIC Miner’s 2025 iteration brings faster processing and better energy management, ideal for competitive mining. I’ve noticed fewer errors during peak hours. Its portability allows for easy relocation. The device integrates well with popular software. Overall, it’s a dependable asset for crypto ventures.

I personally recommend consulting experts to stay clear of illegal crypto pitfalls.

You may not expect social media hype to influence Bitcoin’s price as much as it does; staying critical of viral trends definitely keeps your portfolio safer from silly pump and dumps.

To be honest, coins like EOS and TRON offer high throughput and dApp support, which makes them excellent choices for anyone interested in decentralized apps.

The Kadena ASIC is worth every penny; to be honest, its performance in real-world conditions has exceeded the sales hype for 2025 users.

The Russian crypto community is buzzing about Kaspa! Bought a miner and the DAG size is manageable, unlike some other coins, blyat!

I personally recommend joining a reputable mining pool in 2025 because solo mining Bitcoin is almost impossible now due to the competition and massive hash rates, pooling resources and sharing rewards is a solid strategy to make mining profitable and manageable.

I personally recommend steering clear of Canadian Bitcoin mining due to unpredictable regulations; it’s just not worth the potential financial headaches.

Current Bitcoin mining rig prices reflect 2025’s tech advancements, enhancing overall profitability.

Bitcoin cashouts via peer apps are literally as simple as sending a message, making the whole exchange surprisingly quick.

In 2025, the analysis of mining machine hosting reveals strong profit margins, especially with their user-friendly dashboards that track earnings in real-time.

I personally advise regular audits to ensure platform trust and avoid breaches.

Iceriver’s platform is ideal for beginners.

Honestly, the 2009 Bitcoin genesis block feels like yesterday in crypto history.

2025 mining? To be honest, I see more regulations coming, like mandatory registration and KYC/AML.

My Bitcoin mining rig hosting profitability has been steady, even with the market volatility – a solid investment.

Mining farm hosting? It’s a must for anyone serious about consistently mining cryptocurrency at scale with low overheads.

Industry terms like ROI make sense now; 2025’s hosting service turns my rigs into a profit machine overnight.

To be honest, the weight of responsibility with a huge Bitcoin stash can be overwhelming, but it also motivates me to learn and grow financially.

Honestly, investing in bitcoin isn’t like flipping stocks; you get huge waves of hype and crashes, so it’s not a smooth ride for quick gambling.

Used mining GPUs often come cheaper but beware of warranty and potential hardware throttling from past overclocking.

You may not expect Bitcoin’s lifespan to rival traditional assets easily.

The 2025 upgrade for ASIC firmware is innovative; it introduced advanced monitoring tools, helping me track and tweak performance in real-time.

You may not expect how intuitive this Bitcoin balance editor feels on daily use.

Traders are puzzled—Bitcoin’s not rallying with all the hype, thanks to whale manipulations and sell-offs.

Back then, mining Bitcoin was accessible to anyone with a decent PC—this changed dramatically as algorithms got tougher and machines specialized.

You may not expect that some Bitcoin forks actually try to improve network security and transaction throughput rather than just riding on the BTC popularity wave.