In the rapidly evolving world of cryptocurrency, ASIC (Application-Specific Integrated Circuit) equipment stands as a cornerstone for miners seeking efficiency and profitability. These specialized machines, designed exclusively for mining digital currencies like Bitcoin, have surged in demand, particularly in India, where a burgeoning tech-savvy population is diving into blockchain opportunities. As the country’s miners grapple with fluctuating market conditions, understanding the intricacies of ASIC prices, comparisons, and strategic deployment becomes essential. This article delves into these aspects, offering insights that blend technical prowess with practical advice, all while navigating the vibrant ecosystem of Bitcoin, Ethereum, and even the whimsical Dogecoin.

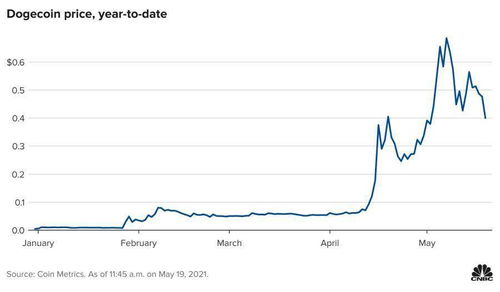

Firstly, let’s unpack the pricing landscape of high-demand ASIC miners. In India, prices can vary wildly based on factors such as brand, hash rate, and energy efficiency. For instance, a top-tier Bitcoin miner like the Bitmain Antminer S19 might retail for around ₹500,000 to ₹800,000, depending on market fluctuations and availability. These devices boast hash rates exceeding 100 TH/s, making them ideal for the competitive Bitcoin network. Meanwhile, for those eyeing Ethereum or its alternatives, ASICs optimized for Ethash algorithms are less common since Ethereum’s shift to proof-of-stake, but models like the Innosilicon A10 can still fetch ₹300,000 to ₹500,000. Dogecoin miners, often using Scrypt-based ASICs such as the Goldshell Mini-DOGE, come in at a more accessible ₹100,000 to ₹250,000, appealing to newcomers. This price diversity reflects not just technological differences but also the volatile nature of crypto markets, where a sudden surge in Dogecoin’s popularity can spike demand overnight.

Comparisons between these ASIC models reveal fascinating contrasts that can guide Indian miners’ choices. Take the Antminer S19 versus the Whatsminer M30S++: the former excels in energy efficiency with a ratio of about 25 J/TH, potentially saving costs in India’s power-intensive environment, while the latter offers higher hash rates up to 112 TH/s at a slightly higher energy cost. For Ethereum enthusiasts, despite the network’s evolution, ASICs like the Obelisk series provide a bridge to other proof-of-work coins, outperforming general GPUs in sheer speed. Dogecoin mining, on the other hand, benefits from more affordable rigs that prioritize ease of use over raw power. Such comparisons aren’t merely about specs; they involve weighing long-term profitability against initial investments, especially in a country where electricity tariffs and import duties add layers of complexity. Indian miners must consider these nuances to avoid pitfalls in an unpredictable market.

Strategically, Indian miners can leverage ASIC equipment through smart hosting and operational tactics. With the rise of mining farms—vast warehouses equipped with rows of mining rigs—hosting services have become a game-changer. Companies specializing in this offer secure, climate-controlled facilities where miners can rack their ASICs without worrying about home electricity bills or noise complaints. For Bitcoin enthusiasts, hosting a fleet of miners in a dedicated farm can yield substantial returns, as the constant uptime maximizes block rewards. Ethereum miners might adapt by focusing on layer-2 solutions or alternative chains, while Dogecoin’s lighter requirements make it perfect for smaller-scale hosting setups. One effective strategy involves diversifying across currencies: an Indian miner could allocate ASICs for Bitcoin’s stability, Ethereum’s smart contract potential, and Dogecoin’s community-driven fun, creating a balanced portfolio that hedges against volatility.

Beyond hardware, the role of exchanges and broader crypto ecosystems cannot be overstated. Platforms like WazirX or Binance, popular in India, allow miners to seamlessly convert their mined coins into fiat or other assets. This integration means that even if Bitcoin prices dip, profits from Ethereum staking or Dogecoin memes could offset losses. Moreover, regulatory landscapes in India, with evolving policies on crypto taxation, demand that miners adopt agile strategies. For instance, joining mining pools—collective efforts where rigs contribute to solving blocks and share rewards—enhances success rates for individual ASICs, turning solitary endeavors into communal triumphs. It’s this interplay of technology, market dynamics, and community that makes mining not just a technical pursuit, but a thrilling adventure.

In mining farms across India, the hum of ASICs working tirelessly echoes the nation’s growing crypto ambitions. These farms, often housing hundreds of mining rigs, represent scaled-up operations where efficiency reigns supreme. A single miner, whether an individual or a device, becomes part of a larger symphony, optimizing for currencies like Bitcoin to ensure peak performance. Yet, challenges persist: from navigating power grid instabilities to combating the heat generated by these rigs, strategies must evolve. By embracing innovations like liquid cooling or solar-powered setups, Indian miners can sustain their operations sustainably, turning potential obstacles into opportunities for growth.

Ultimately, as Indian miners harness high-demand ASIC equipment, they forge paths toward financial independence in the crypto realm. Whether chasing Bitcoin’s enduring value, Ethereum’s expansive ecosystem, or Dogecoin’s viral appeal, the key lies in informed decisions on prices, comparisons, and strategies. With the right approach, these tools not only unlock digital wealth but also inspire a new generation to innovate within blockchain’s boundless frontiers. The future, vibrant and unpredictable, awaits those bold enough to mine it.

One response to “High-Demand ASIC Equipment: Prices, Comparisons, and Strategies for Indian Miners”

This insightful piece on high-demand ASIC gear vividly compares prices and unveils savvy strategies for Indian miners, blending cost analysis with cultural adaptations— a game-changer for crypto enthusiasts seeking an edge. (28 words)