In the ever-evolving world of cryptocurrencies, Bitcoin stands as a titan, its mining operations forming the backbone of a decentralized financial revolution. Navigating the landscape of Bitcoin mining hardware expenses in the USA requires a keen understanding of both technological advancements and economic pressures. As companies specialize in selling and hosting mining machines, enthusiasts and professionals alike must weigh the costs against potential rewards. From the hum of high-powered rigs to the strategic placement in data centers, the journey into Bitcoin mining is fraught with excitement and challenges.

Delving deeper, the expenses associated with Bitcoin mining hardware can be staggering, often starting with the purchase of specialized ASICs—Application-Specific Integrated Circuits—designed exclusively for mining BTC. These machines, far from the generic computers of yesteryear, demand significant upfront investment, with top-tier models from manufacturers like Bitmain or Canaan reaching prices upwards of $10,000 per unit in the US market. Yet, it’s not just the initial cost; electricity consumption turns into a relentless drain on resources, as these beasts devour kilowatt-hours at an alarming rate. In contrast, the rise of alternative cryptocurrencies like Ethereum and Dogecoin introduces variability—ETH miners might opt for GPU-based rigs, which offer more flexibility but come with their own volatile price tags, while DOG’s Proof-of-Work setup appeals to those seeking quicker returns with less intensive hardware.

Amid this complexity, mining farms emerge as a beacon for efficiency, vast warehouses filled with synchronized miners churning out blocks day and night. In the USA, states like Texas and Washington have become hotspots due to their cheap electricity and cooler climates, reducing operational costs for hosting services. Companies that sell and host these machines provide a lifeline, allowing individuals to bypass the hassles of setup and maintenance. Imagine rows upon rows of mining rigs, their fans whirring in unison, all under the watchful eye of expert technicians—it’s a symphony of technology that transforms raw hardware into profitable ventures.

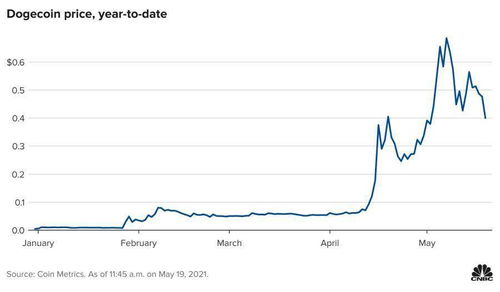

Exchanges play a pivotal role in this ecosystem, bridging the gap between mined coins and real-world value. Platforms such as Coinbase or Binance enable miners to sell their BTC, ETH, or DOG holdings instantly, but fluctuations in market prices can turn a profitable mining operation into a financial quagmire overnight. For instance, while Bitcoin’s halving events periodically slash rewards, Ethereum’s shift to Proof-of-Stake might render traditional mining rigs obsolete, pushing miners toward adaptive strategies. This unpredictability underscores the need for diversified portfolios, where a mix of currencies mitigates risks and enhances long-term sustainability.

Turning to the specifics of mining rigs, the hardware landscape is a battlefield of innovation and obsolescence. A standard Bitcoin miner, equipped with chips optimized for SHA-256 hashing, contrasts sharply with the versatile setups for ETH, which rely on powerful GPUs capable of handling complex algorithms. Dogecoin mining, often seen as more accessible, can be tackled with less specialized equipment, yet it still demands reliable cooling systems to prevent overheating in the relentless pursuit of blocks. In the USA, regulatory hurdles add another layer, with environmental concerns pushing for greener alternatives like hydroelectric-powered farms that lower both costs and carbon footprints.

As we gaze toward the future, the expenses of mining hardware in the USA will likely evolve with technological leaps, such as quantum-resistant algorithms or integrated AI optimizations. For businesses focused on selling and hosting miners, adapting to these changes means offering comprehensive packages that include not just the machines, but also educational resources and community support. Whether you’re a novice drawn to the allure of DOG’s community-driven ethos or a seasoned pro targeting ETH’s smart contract capabilities, the key lies in balancing investment with innovation. Ultimately, navigating this landscape demands resilience, a dash of foresight, and an unyielding passion for the crypto frontier.

One response to “Navigating the Landscape: Bitcoin Mining Hardware Expenses in the USA”

This article offers a comprehensive exploration of the financial intricacies surrounding Bitcoin mining hardware in the USA. It delves into cost variance based on technology, energy consumption, and market trends, providing valuable insights for potential miners. The analysis of ROI and equipment longevity adds depth, making it essential reading for enthusiasts and investors alike.